As a former Mint consumer, I needed to discover a new budgeting app not too way back. Intuit, guardian firm of Mint, shut down the service in March 2024, and prompted customers to transition to its different monetary app, Credit score Karma. Nonetheless, after testing Credit score Karma myself, I discovered it to be a poor Mint substitute — that meant I wanted to department out and look elsewhere for a trusted app to trace all of my monetary accounts, monitor my credit score rating, comply with a month-to-month spending plan and set objectives like constructing a rainy-day fund and paying down my mortgage quicker.

I attempted out Mint’s top competitors within the hopes that I might be capable of discover a new budgeting app that might deal with all of my monetary wants. Hopefully my journey may also help you discover one of the best budgeting app for you and your cash as nicely.

Finest funds apps of 2025

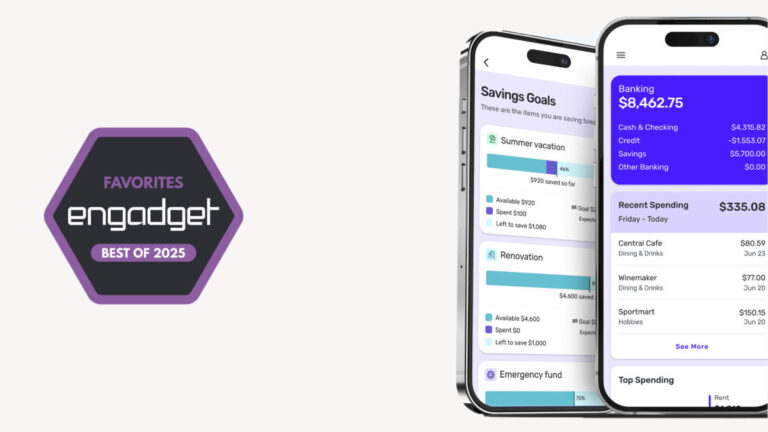

No pun supposed, however what I like about Quicken Simplifi is its simplicity. Whereas different budgeting apps attempt to distinguish themselves with darkish themes and customizable emoji, Simplifi has a clear consumer interface, with a touchdown web page that you just simply maintain scrolling by way of to get an in depth overview of all of your stats. These embody your top-line balances; web price; latest spending; upcoming recurring funds; a snapshot of your spending plan; prime spending classes; achievements; and any watchlists you’ve arrange. You too can arrange financial savings objectives elsewhere within the app. I additionally respect the way it presents neat, nearly playful visualizations with out ever wanting cluttered. I felt at residence within the cell and internet dashboards after a day or so, which is quicker than I tailored to some competing providers (I’m you, YNAB and Monarch).

Getting arrange with Simplifi was principally painless. I used to be significantly impressed at how simply it related to Constancy; not all funds trackers do, for no matter cause. That is additionally one of many solely providers I examined that offers you the choice of inviting a partner or monetary advisor to co-manage your account. One factor I’d add to my preliminary evaluation of the app, having used it for just a few months now: I want Simplifi provided Zillow integration for simply monitoring your house worth (or a minimum of a tough estimate of it). Numerous opponents together with Monarch Cash and Copilot Cash work with Zillow, so clearly there is a Zillow API obtainable to be used. Because it stands, Simplifi customers should add actual property manually like every other asset.

In apply, Simplifi miscategorized a few of my bills, however nothing out of the strange in comparison with any of those funds trackers. As you’re reviewing transactions, you can even mark if you happen to’re anticipating a refund, which is a singular characteristic among the many providers I examined. Simplifi additionally estimated my common earnings higher than another apps I examined. Most of all, I appreciated the choice of with the ability to categorize some, however not all, purchases from a service provider as recurring. As an illustration, I can add my two Amazon subscribe-and-saves as recurring funds, with out having to create a broad-strokes rule for each Amazon buy.

The budgeting characteristic can also be self-explanatory. Simply examine that your common earnings is correct and make sure you arrange recurring funds, making word of that are payments and that are subscriptions. That is essential as a result of Simplifi exhibits you your complete take-home earnings in addition to an “earnings after payments” determine. That quantity contains, nicely, payments however not discretionary subscriptions. From there, you’ll be able to add spending targets by class within the “deliberate spending” bucket. Deliberate spending also can embody one-time expenditures, not simply month-to-month budgets. Once you create a funds, Simplifi will counsel a quantity primarily based on a six-month common.

Not dealbreakers, however two issues to bear in mind as you get began: Simplifi is notable in you can’t arrange an account by way of Apple or Google. There’s additionally no choice for a free trial, although Quicken guarantees a “30-day a reimbursement assure.”

- Straightforward-to-use app with a delicate studying curve

- Does an excellent job detecting recurring earnings and payments

- Cheaper than the competitors

- Helps you to share app entry with a partner or monetary advisor

- Helpful refund tracker

- No free trial

- You possibly can’t create an account utilizing your Apple or Google ID

- No Zillow integration

Monarch Money grew on me. My first impression of the budgeting app, which was based by a former Mint product supervisor, was that it is tougher to make use of than others on this record, together with Simplifi, NerdWallet and Copilot. And it’s. Modifying expense classes, including recurring transactions and creating guidelines, for instance, is a bit more sophisticated than it must be, particularly within the cell app. (My recommendation: Use the online app for fine-tuning particulars.) Monarch additionally didn’t get my earnings proper; I needed to edit it.

When you’re arrange, although, Monarch presents a powerful degree of granularity. Within the budgets part, you’ll be able to see a bona fide stability sheet displaying budgets and actuals for every class. You may additionally discover a forecast, for the 12 months or by month. And recurring bills will be set not simply by service provider, however different parameters as nicely. As an illustration, whereas most Amazon purchases could be marked as “buying,” these for the quantities of $54.18 or $34.18 are positively child provides, and will be routinely marked as such every time, to not point out programmed as recurring funds. Weirdly, although, there’s no method to mark sure recurring funds as payments, particularly.

Not lengthy after I first printed this story in December 2023, Monarch introduced an in depth reporting part the place you’ll be able to create on-demand graphs primarily based on issues like accounts, classes and tags. That characteristic is obtainable simply on the net model of the app for now. As a part of this similar replace, Monarch added assist for an aggregator that makes it potential to routinely replace the worth of your automotive. This, mixed with the prevailing Zillow integration for monitoring your house worth, makes it simple to rapidly add a non-liquid asset like a automobile or actual property, and have it present up in your web price graph.

The cell app is generally self-explanatory. The primary dashboard exhibits your web price; your 4 most up-to-date transactions; a month-over-month spending comparability; earnings month-to-date; upcoming payments; an investments snapshot; an inventory of any objectives you’ve set; and, lastly, a hyperlink to your month-in-review. That month-in-review is extra detailed than most, delving into money move; prime earnings and expense classes; money move tendencies; adjustments to your web price, belongings and liabilities; plus asset and legal responsibility breakdowns. In February 2024, Monarch expanded on the net worth graph, in order that if you happen to click on on the Accounts tab you’ll be able to see how your web price modified over completely different durations of time, together with one month, three months, six months, a 12 months or all time.

On the primary display, you’ll additionally discover tabs for accounts, transactions, money move, funds and recurring. Like lots of the different apps featured right here, Monarch can auto-detect recurring bills and earnings, even when it will get the class unsuitable. (All of them do to an extent.) Expense classes are marked by emoji, which you’ll customise if you happen to’re so inclined.

Monarch Cash makes use of a mixture of networks to attach with banks, together with Plaid, MX and Finicity, a competing community owned by Mastercard. (I’ve a fast explainer on Plaid, the business commonplace on this house, towards the tip of this information.) As a part of an replace in late December, Monarch has additionally made it simpler to attach by way of these different two networks, if for some cause Plaid fails. Much like NerdWallet, I discovered myself finishing two-factor authentication each time I needed to get previous the Plaid display so as to add one other account. Notably, Monarch is the one different app I examined that permits you to grant entry to another person in your loved ones — doubtless a partner or monetary advisor.

Moreover, Monarch simply added the flexibility to trace Apple Card, Apple Money, and Financial savings accounts, due to new performance introduced with the iOS 17.4 replace. It isn’t the one one both; at present, Copilot and YNAB have additionally added related performance that shall be obtainable to anybody with the most recent variations of their respective apps on a tool working iOS 17.4. As a substitute of manually importing statements, the brand new performance permits apps like Monarch’s to routinely pull in transactions and stability historical past. That ought to make it simpler to account for spending on Apple playing cards and accounts all through the month.

Monarch additionally lately launched funding transactions in beta. It additionally says invoice monitoring and an overhauled objectives system are coming quickly. Monarch hasn’t offered a timeline for that final one, besides to say that the improved objectives characteristic is coming quickly.

- A lot of element and alternatives for personalization

- Useful “objectives” characteristic

- You possibly can grant account entry to different individuals

- Chrome extension for importing from Mint

- Month-in-review recap is extra thorough than most

- Automobile worth syncing

- Zillow integration

- Steeper studying curve than another funds trackers

- The cell app feels restricted and fewer intuitive than the online model

- Doesn’t appear to tell apart between payments and different recurring bills

- Some bugginess on cell round creating guidelines for expense classes

You could know NerdWallet as a web site that provides a mixture of private finance information, explainers and guides. I see it typically once I google a monetary time period I don’t know and positive sufficient, it’s one of many websites I’m most probably to click on on. Because it occurs, NerdWallet additionally has the excellence of providing one of many solely free budgeting apps I examined. The truth is, there isn’t any paid model; nothing is locked behind a paywall. The primary catch: There are adverts in all places.

Even with the inescapable bank card presents, NerdWallet has a clear, easy-to-understand consumer interface, which incorporates each an online and a cell app. The important thing metrics that it highlights most prominently are your money move, web price and credit score rating. I significantly loved the weekly insights, which delve into issues like the place you spent essentially the most cash or how a lot you paid in charges — and the way that compares to the earlier month. As a result of that is NerdWallet, an encyclopedia of economic information, you get some significantly particular class choices when organising your accounts (assume: a Roth or non-Roth IRA).

As a budgeting app, NerdWallet is greater than serviceable, if a bit primary. Like different apps I examined, you’ll be able to arrange recurring payments. Importantly, it follows the favored 50/30/20 budgeting rule, which has you placing 50% of your funds towards belongings you want, 30% towards belongings you need, and the remaining 20% into financial savings or debt repayments. If this works for you, nice — simply know you can’t customise your funds to the identical diploma as some competing apps. You possibly can’t at present create customized spending classes, although a word contained in the dashboard part of the app says “you’ll be capable of customise them sooner or later.” You can also’t transfer gadgets from the needs column to “wants” or vice versa however “Sooner or later, you’ll transfer particular transactions to actively handle what falls into every group.” A NerdWallet spokesperson declined to supply an ETA, although.

Lastly, it’s price noting that NerdWallet had probably the most onerous setup processes of any app I examined. I don’t assume this can be a dealbreaker, as you’ll solely need to do it as soon as and, hopefully, you aren’t organising six or seven apps in tandem as I used to be. What made NerdWallet’s onboarding particularly tedious is that each time I needed so as to add an account, I needed to undergo a two-factor authentication course of to even get previous the Plaid splash display, and that’s not together with the 2FA I had arrange at every of my banks. It is a safety coverage on NerdWallet’s finish, not Plaid’s, a Plaid spokesperson says.

Exactly as a result of NerdWallet is likely one of the solely funds trackers to supply credit score rating monitoring, it additionally wants extra of your private information throughout setup, together with your birthday, handle, telephone quantity and the final 4 digits of your social safety quantity. It’s the identical with Credit score Karma, which additionally does credit score rating monitoring.

Associated to the setup course of, I discovered that NerdWallet was much less adept than different apps at routinely detecting my common earnings. In my case, it counted a big one-time wire switch as earnings, at which level my solely different choice was to enter my earnings manually (which is barely annoying as a result of I’d have wanted my pay stub useful to double-check my take-home pay).

- Free

- Straightforward to make use of

- Useful weekly insights

- NerdWallet has a deep nicely of useful monetary explainers and guides

- One of many few choices that provides credit score rating monitoring

- Adverts in all places

- No customization for spending classes

- Much less adept at detecting common earnings

- One of many extra tedious setup processes

Copilot Money could be the best-looking budgeting app I examined. It additionally has the excellence of being unique to iOS and Macs — a minimum of for now. Andres Ugarte, the corporate’s CEO, has publicly promised that Android and internet apps are coming quickly. However till it follows by way of, I can’t suggest Copilot for most individuals with so many good opponents on the market.

There are different options that Copilot is lacking, which I’ll get into. However it’s promising, and one to regulate. It’s only a quick, environment friendly, nicely designed app, and Android customers shall be in for a deal with after they’ll lastly be capable of obtain it. It makes good use of colours, emoji and graphs that will help you perceive at a look the way you’re doing on all the things out of your budgets to your funding efficiency to your bank card debt over time. Specifically, Copilot does a greater job than nearly every other app of visualizing your recurring month-to-month bills.

Behind these punchy colours and cutesy emoji, although, is a few refined efficiency. Copilot’s AI-powered “Intelligence” will get smarter as you go at categorizing your bills. (You too can add your personal classes, full along with your selection of emoji.) It’s not excellent. Copilot miscategorized some purchases (all of them do), nevertheless it makes it simpler to edit than most. On prime of that, the inner search characteristic could be very quick; it begins whittling down ends in your transaction historical past as quickly as you start typing.

Copilot can also be distinctive in providing Amazon and Venmo integrations, permitting you to see transaction particulars. With Amazon, this requires simply signing into your Amazon account through an in-app browser. For Venmo, it’s a must to arrange [email protected] as a forwarding handle after which create a filter, whereby emails from [email protected] are routinely forwarded to [email protected]. Like Monarch Cash, you can even add any property you personal and observe its worth by way of Zillow, which is built-in with the app.

Whereas the app is closely automated, I nonetheless respect that Copilot marks new transactions for assessment. It’s a great way to each weed out fraudulent prices, and likewise be considerably intentional about your spending habits.

Like Monarch Cash, Copilot up to date its app to make it simpler to hook up with banks by way of networks apart from Plaid. As a part of the identical replace, Copilot mentioned it has improved its connections to each American Categorical and Constancy which, once more, generally is a bugbear for some funds monitoring apps. In an much more latest replace, Copilot added a Mint import choice, which different budgeting apps have begun to supply as nicely.

As a result of the app is comparatively new (it launched in early 2020), the corporate continues to be catching as much as the competitors on some table-stakes options. Ugarte instructed me that his group is nearly completed constructing out an in depth money move part as nicely. On its website, Copilot additionally guarantees a raft of AI-powered options that construct on its present “Intelligence” platform, the one which powers its good expense categorization. These embody “good monetary objectives,” pure language search, a chat interface, forecasting and benchmarking. That benchmarking, Ugarte tells me, is supposed to provide individuals a way of how they’re doing in comparison with different Copilot customers, on each spending and funding efficiency. Most of those options ought to arrive within the new 12 months.

Copilot does a pair fascinating issues for brand new prospects that distinguish it from the competitors. There’s a “demo mode” that looks like a sport simulator; no want so as to add your personal accounts. The corporate can also be providing two free months with RIPMINT — a extra beneficiant introductory provide than most. When it lastly does come time to pony up, the $7.92 month-to-month plan is cheaper than some competing apps, though the $95-a-year-option is in the identical ballpark.

- Slick UI

- Standalone Mac app

- Decrease month-to-month value than some competing apps

- Does an excellent job visualizing recurring bills

- Optionally available Amazon, Venmo and Zillow integration

- “To assessment” part is useful

- No internet or Android app but

- Miscategorized extra bills than our prime decide

- A lot of in any other case widespread options are nonetheless in growth

YNAB is, by its own admission, “completely different from something you’ve tried earlier than.” The app, whose title is brief for You Want a Funds, is a so-called zero-based budgeting app, which forces you to assign a goal for each greenback you earn. It is akin to the envelope budgeting methodology in that you just put every greenback in an envelope and you may at all times transfer cash from one envelope to a different in a pinch. These buckets can embody lease and utilities, together with unexpected bills like vacation items and the inevitable automotive restore. The thought is that if you happen to funds a specific amount for the unknowns every month, they received’t really feel like they’re sneaking up on you.

Importantly, YNAB is simply involved with the cash you will have in your accounts now. The app doesn’t ask you to supply your take-home earnings or arrange recurring earnings funds (though there’s a approach to do that). The cash you’ll make later within the month by way of your salaried job just isn’t related, as a result of YNAB doesn’t interact in forecasting.

The app is tougher to be taught than every other right here, and it requires extra ongoing effort from the consumer. And YNAB is aware of that. Inside each the cell and internet apps are hyperlinks to movies and different tutorials. Though I by no means fairly bought snug with the consumer interface, I did come to understand YNAB’s insistence on intentionality. Forcing customers to draft a brand new funds every month and to assessment every transaction just isn’t essentially a foul factor. As YNAB says on its web site, “Certain, you’ve bought pie charts displaying that you just spent an obscene sum of money in eating places — however you’ve nonetheless spent an obscene sum of money in eating places.” I can see this strategy being helpful for individuals who don’t are likely to have numerous money in reserve at a given time, or who’ve spending habits they need to appropriate (to riff off of YNAB’s personal instance, ordering Seamless 4 occasions per week).

My colleague Valentina Palladino, realizing I used to be engaged on this information, penned a respectful rebuttal, explaining why she’s been utilizing YNAB for years. Maybe, like her, you will have main financial savings objectives you need to obtain, whether or not it’s paying for a marriage or shopping for a home. I counsel you give her column a learn. For me, although, YNAB’s strategy looks like overkill.

- Notably robust emphasis on budgeting

- Distinctive “zero-dollar” strategy to monetary planning that some individuals swear by

- Steep studying curve

- More durable to make use of sure options on the cell app than on the net

PocketGuard is likely one of the solely respected free funds trackers I discovered in my analysis. Simply understand it’s way more restricted on the free tier than NerdWallet. In my testing, I used to be prompted to pay after I tried to hyperlink greater than two financial institution accounts. A lot free of charge, except you retain issues easy with one money account and one bank card. When it comes time to improve to PocketGuard Plus, you will have three choices: pay $7.99 a month, $34.99 a 12 months or $79.99 for a one-time lifetime license. That lifetime choice is definitely one of many few distinctive promoting factors for me: I’m positive some individuals will respect paying as soon as and by no means having to, uh, funds for it once more.

From the primary display, you’ll see tabs for accounts, insights, transactions and the “Plan,” which is the place you see recurring funds stacked on prime of what appears like a funds. The primary overview display exhibits you your web price, complete belongings and money owed; web earnings and complete spending for the month; upcoming payments; a useful reminder of when your subsequent paycheck lands; any debt payoff plan you will have; and any objectives.

Like another apps, together with Quicken Simplifi, PocketGuard promotes an “after payments” strategy, the place you enter your entire recurring payments, after which PocketGuard exhibits you what’s left, and that’s what you’re imagined to be budgeting: your disposable earnings. Clearly, different apps have a unique philosophy: have in mind your entire post-tax earnings and use it to pay the payments, buy belongings you need and perhaps even save a bit. However in PocketGuard, it’s the “in your pocket” quantity that’s most distinguished. To PocketGuard’s credit score, it does an excellent job visualizing which payments are upcoming and which of them you’ve already paid.

In early 2024, PocketGuard additionally publicly committed to including some in style options. These embody rollover budgeting, categorization guidelines and shared family entry.

Though PocketGuard’s UI is straightforward sufficient to know, it lacks polish. The “accounts” tab is a bit busy, and doesn’t present totals for classes like money or investments. Seemingly small particulars like weirdly phrased or punctuated copy often make the app really feel janky. Greater than as soon as, it prompted me to replace the app when no updates had been obtainable. The net model, in the meantime, feels just like the cell app blown as much as a bigger format and doesn’t benefit from the additional display actual property.

Of word, though PocketGuard does work with Plaid, its major bank-connecting platform is definitely Finicity. Organising my accounts by way of Finicity was principally an easy course of. I did encounter one hiccup: Finicity wouldn’t hook up with my SoFi account. I used to be capable of do it by way of Plaid, however PocketGuard doesn’t make it simple to entry Plaid within the app. The one approach, so far as I can inform, is to knowingly seek for the title of a financial institution that isn’t obtainable by way of Finicity, at which level you get the choice to attempt Plaid as an alternative. Like I mentioned: the expertise will be janky.

- One of many solely funds trackers with a free plan

- You possibly can keep away from an ongoing subscription price by choosing a one-time lifetime license

- Cheaper than most opponents

- Useful “upcoming payments” view within the app

- The free model is so restricted that the “free” label feels deceptive; the consumer expertise feels much less polished than some competing apps

- The net app doesn’t benefit from the bigger display house on desktop

How we check budgeting apps

Earlier than I dove in and began testing out budgeting apps, I had to do a little analysis. To discover a record of apps to check out, I consulted trusty ol’ Google (and even trustier Reddit); learn opinions of in style apps on the App Retailer; and likewise requested mates and colleagues what funds monitoring apps (or different budgeting strategies) they could be utilizing for cash administration. A number of the apps I discovered had been free and these, after all, present a great deal of adverts (excuse me, “presents”) to remain in enterprise. However a lot of the obtainable apps require paid subscriptions, with costs sometimes topping out round $100 a 12 months, or $15 a month. (Spoiler: My prime decide is cheaper than that.)

The entire providers I selected to check wanted to do a number of issues: import your entire account information into one place; provide budgeting instruments; and observe your spending, web price and credit score rating. Besides the place famous, all of those apps can be found for iOS, Android and on the net.

As soon as I had my shortlist of six apps, I started working setting them up. For the sake of totally testing these apps, I made some extent of including each account to each budgeting app, irrespective of how small or immaterial the stability. What ensued was a veritable Groundhog Day of two-factor authentication. Simply hours of getting into passwords and one-time passcodes, for a similar banks half a dozen occasions over. Hopefully, you solely have to do that as soon as.

Budgeting app FAQs

What’s Plaid and the way does it work?

Every of the apps I examined makes use of the identical underlying community, referred to as Plaid, to drag in monetary information, so it’s price explaining what it’s and the way it works. Plaid was based as a fintech startup in 2013 and is at present the business commonplace in connecting banks with third-party apps. Plaid works with over 12,000 monetary establishments throughout the US, Canada and Europe. Moreover, greater than 8,000 third-party apps and providers depend on Plaid, the company claims.

To be clear, you don’t want a devoted Plaid app to make use of it; the know-how is baked into a wide selection of apps, together with all the budgeting apps listed on this information. As soon as you discover the “add an account” choice in whichever one you’re utilizing, you’ll see a menu of generally used banks. There’s additionally a search subject you should utilize to look yours up instantly. As soon as you discover yours, you’ll be prompted to enter your login credentials. If in case you have two-factor authentication arrange, you’ll have to enter a one-time passcode as nicely.

Because the intermediary, Plaid is a passthrough for data which will embody your account balances, transaction historical past, account kind and routing or account quantity. Plaid makes use of encryption, and says it has a coverage of not promoting or renting buyer information to different corporations. Nonetheless, I’d not be doing my job if I didn’t word that in 2022 Plaid was forced to pay $58 million to consumers in a class action suit for gathering “extra monetary information than was wanted.” As a part of the settlement, Plaid was compelled to alter a few of its enterprise practices.

In an announcement offered to Engadget, a Plaid spokesperson mentioned the corporate continues to disclaim the allegations underpinning the lawsuit and that “the crux of the non-financial phrases within the settlement are targeted on us accelerating workstreams already underway associated to giving individuals extra transparency into Plaid’s position in connecting their accounts, and guaranteeing that our workstreams round information minimization stay on observe.”

Why did Mint shut down?

When guardian firm Intuit announced in December 2023 that it might shut down Mint, it didn’t present a cause why it made the choice to take action. It did say that Mint’s hundreds of thousands of customers could be funneled over to its different finance app, Credit score Karma. “Credit score Karma is thrilled to ask all Minters to proceed their monetary journey on Credit score Karma, the place they may have entry to Credit score Karma’s suite of options, merchandise, instruments and providers, together with a few of Mint’s hottest options,” Mint wrote on its product blog. In our testing, we discovered that Credit score Karma is not an actual substitute for Mint — so if you happen to’re nonetheless searching for a Mint alternative, you will have some first rate choices.

What about Rocket Cash?

Rocket Money is one other free monetary app that tracks spending and helps issues like stability alerts and account linking. Should you pay for the premium tier, the service also can provide help to cancel undesirable subscriptions. We didn’t check it for this information, however we’ll think about it in future updates.