The Indian motor insurance coverage market is at present valued at round $13.19 billion and is projected to succeed in $21.48 billion by 2030. Whereas the business continues to develop steadily, regulators have additionally issued robust mandates to insurers to enhance their turnaround occasions and supply higher buyer experiences.

For one among India’s greatest personal insurers, which prided itself on a excessive declare settlement ratio, this meant discovering new methods to streamline its back-office processes and cut back guide errors. Nevertheless it wasn’t simple. They course of greater than 350,000 instances yearly— every file incorporates over 10 forms of paperwork, various codecs and buildings, 30+ line gadgets, and a number of ingestion channels. They’d a backend staff of 40 knowledge entry clerks and vehicle consultants manually inputting data from restore estimates, invoices, and supporting paperwork into their declare administration system

This inefficient, unscalable workflow could not meet the regulator’s turnaround time mandates, forcing a re-evaluation of their motor declare processing strategy. Let’s discover how they went about it.

What modified in motor declare processing in 2024

In June 2024, IRDAI, the Indian insurance coverage regulator, issued new pointers aimed toward enhancing motor insurance coverage declare settlement processes.

The important thing modifications included:

- No arbitrary rejection of motor insurance coverage claims as a result of lack of paperwork — insurers should request all required paperwork upfront throughout coverage issuance

- Insurers should allocate a surveyor inside 24 hours, get hold of the survey report inside 15 days, and resolve on the declare inside 7 days of receiving the survey report

- Obligatory buyer data sheet (CIS) to offer clear coverage particulars and claims course of

- Restrictions on coverage cancellation, permitting it solely in instances of confirmed fraud with 7-day discover

- Requirement to reveal the insured declared worth (IDV) calculation methodology

Because the insurer’s enterprise grew quickly, these regulatory challenges made dealing with near 30,000 claims month-to-month turned greater than only a processing problem. It uncovered basic operational constraints that threatened their means to scale and ship worth to prospects.

Let’s discover how these modifications affected the insurer’s enterprise:

- Couldn’t scale their operations with out including head depend.

- Unable to satisfy IRDAI’s necessary declare settlement timelines – risking regulatory penalties for violations

- Getting poor opinions and detrimental suggestions from prospects

- Car consultants spending helpful time on knowledge entry as a substitute of price evaluation

These challenges made it unattainable for them to justify premium will increase primarily based on precise declare prices and threat profiles.

Why guide declare processing was difficult

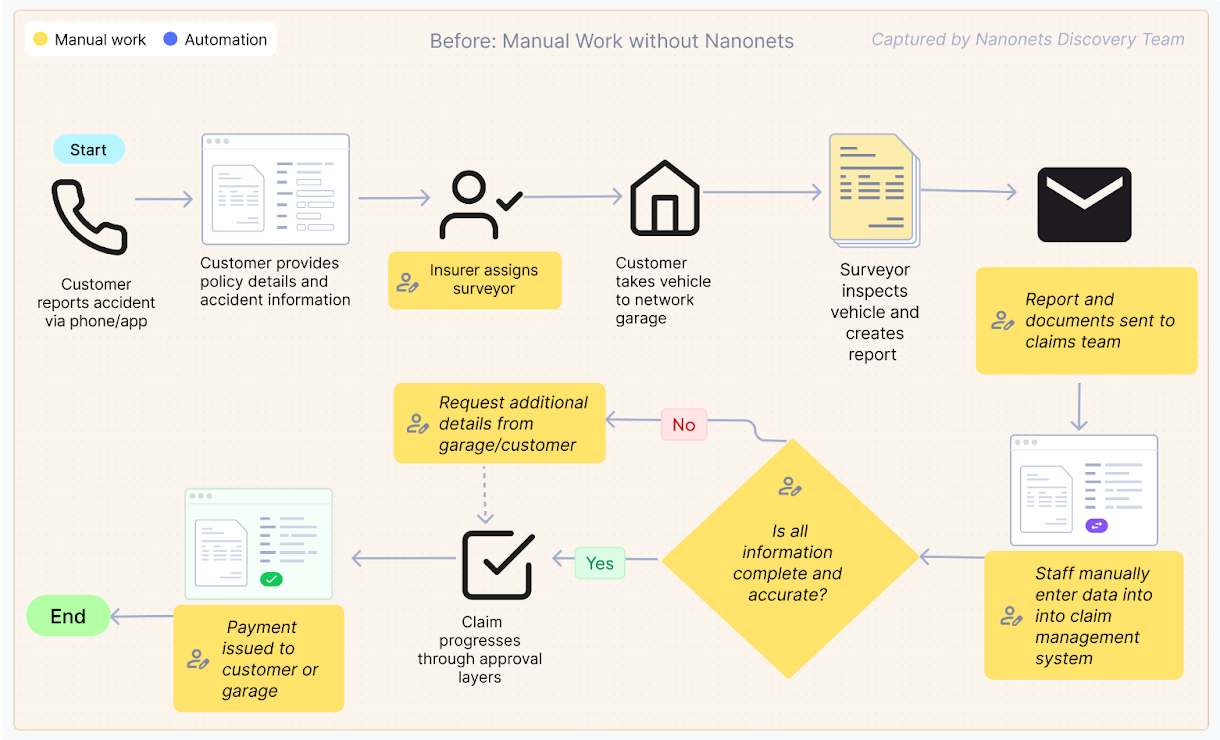

Let’s first attempt to perceive what the insurer’s declare processing workflow used to appear to be.

1. When an accident happens, the shopper can both name up the insurer’s toll-free quantity to register the declare or use their proprietary cell app to finish the declare type.

2. Throughout this, prospects will probably be requested to share coverage quantity, automobile particulars (make, mannequin, registration quantity, and many others.), accident or injury particulars, and police report (if relevant).

3. The client is then requested to take the automobile to one of many insurer’s licensed community garages for inspection and restore. They should submit the required paperwork to the surveyor assigned by the insurer.

4. The surveyor would examine the automobile and put together a report, which might then be submitted to the claims staff.

5. The claims staff would then assess the surveyor’s report and the paperwork submitted, evaluating components like automobile identification, half numbers, unit pricing, and general declare validity.

6. After the evaluation, the staff would manually enter the related particulars into the claims administration system.

7. The declare would then undergo a number of layers of approval earlier than the settlement quantity could possibly be disbursed to the shopper or the storage (in case, the shopper opts for cashless mode)

The backend staff, consisting of 40 knowledge entry clerks and vehicle consultants, manually inputs all the important thing particulars from the declare file into their proprietary declare administration system. This included capturing data from completely different doc varieties, akin to estimates, invoices, registration certificates, driving licenses, and extra.

Do not forget that these paperwork are issued by completely different sources. As an example, a driver’s license issued in a single state might not comply with the identical format because the one issued in one other state.

The staff would meticulously evaluation every line merchandise and half quantity to make sure accuracy earlier than the declare could possibly be additional processed and accepted. One other problem was the inconsistent naming conventions for elements throughout completely different garages and producers – the identical part would have completely different names relying on who submitted the doc.

As an example, what seems as a entrance bumper on one estimate is likely to be listed as a bumper cowl on one other. Equally, the part referred to as a boot in paperwork from UK and German producers would present up as a deck or trunk in producers from different international locations. And not using a standardized database, these variations created fixed confusion.

Mismatches in automobile identification or half numbers, incorrect unit pricing, or lacking paperwork would trigger the declare to return to evaluation. This whole course of may take anyplace from 15 to 30 days, falling in need of the brand new regulatory timelines.

When claims prolonged past IRDAI’s mandated settlement intervals, the implications had been each regulatory and industrial. On the regulatory facet, the insurer confronted financial penalties and present trigger notices. Commercially, these delays broken their market status and prompted formal buyer complaints, which require important time and sources to resolve. The prolonged processing drove up operational prices, as claims wanted further touchpoints and extended dealing with, additionally leading to buyer dissatisfaction.

The insurer shortly realized that this inefficient workflow couldn’t sustain with the rising enterprise calls for and the stricter regulatory necessities.

How the insurer automated its declare processing workflow

The insurer knew they needed to step up their recreation. A few of the opponents, particularly the absolutely digital-first insurers, had already began rolling out zero-touch declare processing.

They explored a number of OCR options, however shortly realized such instruments received’t reduce it. These instruments had been closely depending on format and construction consistency. This led to formatting errors and inconsistent extraction, and extra guide interventions. And to make issues worse, they might solely feed sure doc codecs into the system, leaving a good portion of the declare information untouched.

The insurer discovered they wanted a format-agnostic resolution that might deal with all doc varieties, extract the fitting data, and combine seamlessly into their current claims administration system. After evaluating a number of AI-powered doc processing platforms, they selected to go along with Nanonets’ Clever Doc Processing (IDP) resolution.

Right here’s why:

- Simplicity of the PDF extraction workflows

- Line merchandise extraction accuracy

- API and system integration capabilities

- Potential to deal with all doc codecs, together with handwritten and semi-structured paperwork

- Multi-lingual capabilities

We at Nanonets labored with the insurer to create a tailor-made doc processing resolution that match their particular claims workflow. The implementation targeted on incremental enhancements relatively than a whole in a single day transformation.

The staff started by tackling probably the most vital paperwork within the claims course of: estimates, invoices, and pre-invoices. These paperwork include the important details about automobile damages, required repairs, and related prices.

The preliminary section targeted on:

- Configuring OCR fashions to extract line gadgets from restore invoices and estimates

- Creating methods to differentiate elements from labor prices

- Constructing validation guidelines to flag potential knowledge inconsistencies

- Integrating with the insurer’s software on their proprietary declare administration system by way of API

The workflow was simple. Right here’s what it seemed like:

- Declare initiation and doc assortment: When a declare occasion happens, policyholders provoke the declare type by way of the insurer’s person interface or customer support. The declare type collects fundamental particulars together with important paperwork together with restore estimates, invoices, and supporting documentation.

- Doc submission to Nanonets: As soon as uploaded to the insurer’s system, these paperwork are mechanically routed to Nanonets by way of API integration. Beforehand, a staff of 40 backend staff would manually evaluation and enter data from these paperwork into their system.

- Clever doc processing: Nanonets processes the paperwork utilizing specialised fashions to:

- Classify every doc sort mechanically (bill, estimate, registration certificates, and many others.) and route it to the fitting knowledge extraction mannequin

- The mannequin extracts structured knowledge from each standardized and non-standardized codecs

- Learn and set up line gadgets from restore estimates and invoices

- Distinguish between elements and labor fees utilizing key phrase recognition

- Components database validation: Extracted half data is validated towards a complete elements grasp database that:

- Standardizes various half names throughout completely different garages (bumper vs. cowl)

- Identifies potential little one half replacements (akin to door pores and skin versus complete door meeting)

- Categorizes supplies (plastic, glass, steel) for correct price evaluation

- Information integration: The extracted and validated data is shipped again into the insurer’s system as a customized JSON file, mechanically populating the suitable fields within the declare evaluation interface.

- Exception-based evaluation: The backend staff opinions the populated knowledge, focusing solely on flagged exceptions or uncommon instances.

- Approval and settlement: Claims that move validation proceed to approval and settlement, with considerably decreased guide intervention.

The preliminary implementation targeted on core paperwork (estimates, invoices, and pre-invoices), with plans to develop to supporting paperwork like driving licenses, registration certificates, journey permits, health certificates, and tax paperwork.

The influence of automating insurance coverage claims processing

It’s been solely three months because the implementation, however the brand new workflow has already proven promising indicators for the insurer.

Let’s check out the influence:

- 1.5 million pages processed in three months, nearly double the earlier quantity of 760,000 pages

- Standardized naming for about 600 frequent elements that cowl 90% of claims

- Systematically establish alternatives for little one half replacements (like a door pores and skin at ₹5,000 versus a complete door meeting at ₹20,000) – saves a ton of price

- Allow workers to spend much less time on knowledge entry and extra on doc evaluation and exception dealing with

- Simpler to satisfy IRDAI’s regulatory timelines, which require declare choices inside 7 days of receiving the survey report

- Customized JSON integration allows seamless knowledge stream between Nanonets and the insurer’s declare administration system

Proper now, the main focus is on the core paperwork — estimates, invoices, and pre-invoices — because the staff will get snug with the brand new course of. After that, we’ll cowl the remaining doc varieties like driving licenses and registration certificates within the subsequent section — this could reduce guide work by 50%.

What’s subsequent

The following section will develop doc processing to incorporate supporting paperwork like driving licenses, registration certificates, journey permits, health certificates, and tax paperwork. Moreover, we’re working with the identical insurer, automating their medical claims processing workflow.

In case your insurance coverage firm is struggling to cope with mounting paperwork and lacking regulatory deadlines, we might help. Nanonets works along with your current methods to ship actual enhancements with out turning your operation the other way up. Able to see it in motion? Schedule a demo today.